Property firms see continued demand for single-family homes from millennials, ageing boomers who don’t want to buy.

Miles Patterson, 6 years old, rides a scooter on the sidewalk in front of his family's rental townhouse at the BB Living at Vistancia and Verrado community in Peoria, Ariz.

Property developers are pouncing on sustained demand for stand-alone home rentals by taking a big step: Building entire single-family neighborhoods designed for renters.

When the housing market crashed, investors took advantage by buying low-price homes in foreclosure in order to rent them out to tenants. That demand has proven brisk.

The new rental communities look identical to for-sale projects, with pools, fitness centers and walking trails. But they are operated like apartment complexes, with management handling maintenance, lawn care and leasing.

Developers cite growing demand from younger millennials and aging baby boomers who want the additional space and traditional setting of a new single-family neighborhood—without the long-term commitment.

“It used to be that if you were an adult and didn’t own your own home, you were kind of a bum,” said George Casey, a former home builder who is chief executive of Stockbridge Associates, an industry consulting firm. That stigma has now “been blown into a million pieces,” he said.

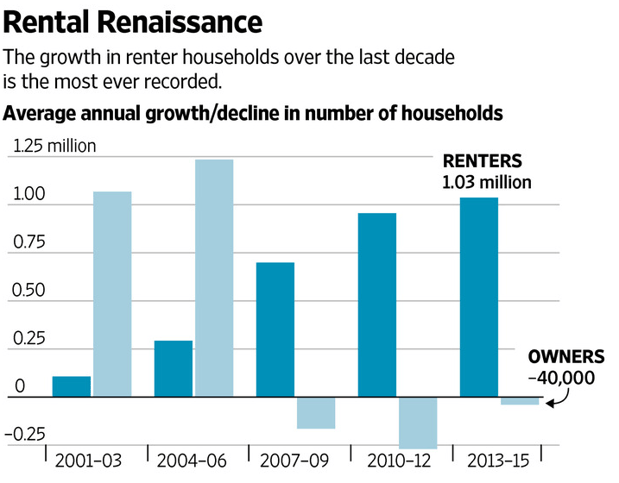

The number of renter households increased by 9 million between 2005 and 2015, marking the largest increase over any 10-year period on record, according to the Harvard Joint Center for Housing Studies. In all, about 5% of all new single-family construction was built for rent in 2016, up from a historical average of less than 3%. Experts say that could expand in coming years if homeownership remains depressed and as older Americans consider downsizing.

Developers building single-family communities for rent said they are transforming what began as a distressed-asset play into a completely new market somewhere between apartment living and homeownership.

“We basically looked at the institutional market and said ‘Would Blackstone, would all of these people be pumping tens of billions of dollars into this space if it wasn’t a good opportunity?’” said Mark Wolf, chief executive of AHV Communities, a California-based single-family rental developer that operates around San Antonio and Austin, Texas, and is looking to expand to North Carolina. “Then we said ‘Looking at what they do, how can we do it better?’”

Amenities packages and proximity to quality school districts are crucial to the business model. By offering perks similar to higher-end apartment complexes, the goal is to attract young families who want good schools but may struggle to buy in certain districts because of insufficient savings or high levels of student debt.

Bobby Bell watches TV in his townhouse at the BB Living at Vistancia and Verrado community in Peoria, Ariz.

The model doesn’t work in all markets. In areas such as California, for example, where land is expensive, developers would likely have to charge rents that would be too high to justify the cost of construction. Markets such as Arizona, Texas and North Carolina make more sense because land is plentiful and demand is high.

“It’s about figuring out what places have the growth, but also have the highest rents possible for the lowest price of the home,” said Shaun McCutcheon, a senior manager who studies the single-family rental market at Meyers Research, a housing consultancy.

National home builder Lennar Corp. has tried the model in one of its master-planned communities outside Reno, Nev. RSI Communities, a home builder in California and Texas, is testing out two fully leased new communities outside San Antonio and is considering expanding the model to other markets.

John Bohnen, RSI’s chief operating officer, said the for-rent approach allows the company to build homes at a faster and more efficient pace than its traditional for-sale operation. That is because builders don’t have to wait to start construction until a sale is completed, giving construction crews that are in high demand more certainty about the number of homes they will build in a given timeframe, thus providing more of a guaranteed pay schedule.

And by exposing tenants to their homes, Mr. Bohnen believes the company could eventually generate demand on the for-sale side.

Matt Blank was a former hedge-fund investor who moved to Phoenix in 2011 to start snapping up distressed properties. He was soon crowded out when major investors like Blackstone Group LP entered the market and prices shot up. He instead turned his attention to buying empty lots and building affordable homes that adults could rent.

His company, BB Living, has since built about 350 rental homes across the Phoenix area, some in stand-alone communities and others alongside owner-occupied homes in large master plans. All six projects he has completed initially sparked controversy from neighbors worried their property values could be impacted by inadequately maintained rentals. But he said he got buy-in after assuring them the properties would be professionally managed and look no different from the surroundings.

“This is a new concept that hasn’t really been done before,” Mr. Blank said. “Once you get around that first hurdle, the pitchforks come down quite a bit.”

Learn more about 2017 Marketing Trends by clicking on the video below