By Katherine Bialczyk

Is it a good idea to invest in real estate? Buy a cottage in Ontario? Or is it better to sit back and wait for the “economy” to correct itself? Well, for those of you lucky enough not to endue lectures about Adam Smith’s “Invisible Hand”, I will give you my two cents on the topic.

After hearing that the current Royal LePage House Price Survey showed the average price of a home in Canada increased between 3.5 and 4.3 per cent in the first quarter of 2011, compared to the previous year, you may be thinking, “Wait, I thought we were in a recession?” Well, this leads us to the housing slump.

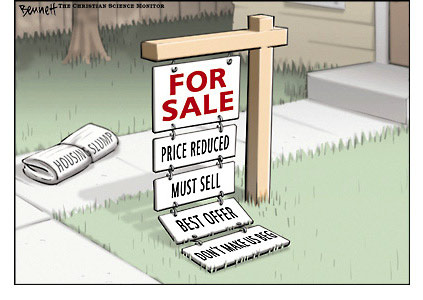

Often, the average individual seems slightly confused by the talk about the housing slump, so I am here to shed some light on the topic.

When the rate of housing purchases slows, it has a severely negative impact on the consumer spending since property is typically the most expensive thing a family or individual will purchase. The strange dichotomy to this situation is that when people don’t spend their money on houses, they tend to save most of their money. This means that all of the banks have a large amount of funds to lend out, but less people are willing to borrow, say for a mortgage. This lowers the cost to borrow (also known as interest rates) and in a sense, lowers the cost to buy a home. Only once consumers recognize the lower interest rates, will there be a turnaround where people begin to buy homes again. Over time, the “housing slump” will correct itself via falling mortgage rates and property values.

This explains why even though the rate of year-over-year price appreciation slowed slightly in the first quarter, home values continued the upward climb starting late in the second quarter of 2009. As markets continued their post-recession recovery, low interest rates and a recovering economy continued to fuel activity in Canada’s housing markets over the past year, which has led to country-wide increases in average home prices. In the first quarter of 2011, the national average price of a detached bungalow rose 4.3 per cent year-over-year to $341,355, while standard two-storey homes rose 3.5 per cent to $379,388 and standard condominiums rose 4 per cent to $237,919.

In Toronto detached bungalows and standard condominiums made healthy gains increasing 4.5 per cent and 3.7 per cent respectively. While in Ottawa, first-time buyers continue to drive the housing market as the region saw year-over-year price appreciation ranging between 5.2 to 5.9 per cent across all housing types surveyed this quarter.

In my opinion, as the economy begins on this upward trend, now is a great time to buy property, invest in real estate or even buy a waterfront cottage. So go have a drink and enjoy some prize Ontario real estate!

Cheers!