This is the next one-minute segment of an interview that I did. I was talking about the six business trends you must know to survive marketing in 2013. The segment for today is about apps as an essential tool.

- About us

- Services

- Projects

- Coaching

-

News

Topics: apps, mobile marketing, android, ipad, mobile, mobile browsing, free marketing evaluation, website

Topics: n5r blog, n5r case studies, Toronto real estate, fan page, apps, social media, facebook, n5r, social media advertising, online marketing

Read MoreGoldman Sachs has reached out to its wealthy private clients, offering them a chance to invest in Facebook, the hot social networking giant that is considering a possible public offering in 2012, according to people familiar with the matter.

On Sunday night, a number of Goldman clients received an email from their Goldman broker, offering them the opportunity to invest in an unnamed “private company that is considering a transaction to raise additional capital.” Another person briefed on the deal said that Goldman clients would have to pony up a minimum of $2 million to invest and would be prohibited from selling their shares until 2013.

A Goldman spokesman declined to comment.

Facebook has raised $500 million from Goldman Sachs and a Russian investor in a transaction that values the company at $50 billion, according to people involved in the transaction. As part of its deal with Facebook, Goldman is expected to raise as much as $1.5 billion from investors for Facebook.

The email sent to Goldman clients warns that recipients who trade in secondary markets where private firms like Facebook trade may want to steer clear of participating because if they opt in they may receive material non-public information on the unnamed company that will restrict future trading.

The email said that even clients who receive the non-public information and decide not to invest would have to wait at least six months and possibly longer before they would be able to trade Facebook shares in the secondary market.

These restrictions are lifted if Facebook goes public in the interim.

Even though Facebook is not a public company it trades on secondary markets. The sellers in these markets are typically former employees of companies like Facebook and investors looking to unload their stakes. The buyers are mostly wealthy speculators looking to snag a piece of the next Apple or Google before the rest of the investing public can.

Goldman clients who opt to receive more information will receive a private placement memorandum from Goldman in the coming days. That document will confirm the company involved is Facebook, and give other more detailed information about the investment.

via NYTImes

Topics: fan page, apps, agent, social media, facebook, marketing

Topics: Toronto real estate, apps, social media, real estate

Topics: toronto marketing, toronto social medias, website optimization, Toronto real estate, fan page, apps, agent, real estate marketing, condominiums in toronto, buy a condo, press release, web site design, web site optimization, toronto properties, toronto condominiums, toronto online marketing, toronto condominiums buying, press releases, toronto press releases, toronto press release, property marketing, direct marketing, app, social media, facebook, social media marketing, real estate, marketing, toronto, twitter, online marketing, innovative marketing tools, website design, buy

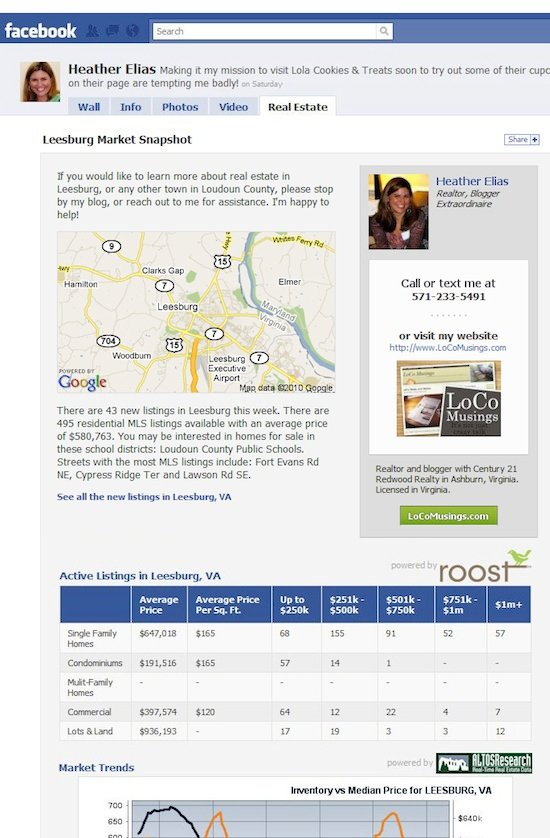

Read MoreWith more small, local businesses using social media to establish an online presence, real estate agents and brokers are no exception, which is why Roost.com is now helping them instantly customize their Facebook Page. The application, called “Social Real Estate”, gives viewers a snapshot of the agent’s listing market.

Features of Roost’s Facebook application include:Topics: fan page, apps, agent, social media, facebook, marketing

Your Email to Subscribe

Archives

- February 2016 (56)

- August 2016 (43)

- November 2014 (36)

- January 2016 (33)

- September 2016 (31)

- October 2016 (31)

- December 2011 (30)

- November 2012 (29)

- December 2014 (26)

- August 2015 (25)

- July 2013 (24)

- September 2015 (24)

- May 2011 (20)

- November 2011 (20)

- June 2016 (20)

- January 2011 (19)

- September 2011 (19)

- June 2012 (19)

- October 2015 (19)

- March 2013 (18)

- April 2013 (18)

- January 2013 (17)

- July 2016 (17)

- January 2012 (16)

- February 2012 (15)

- July 2015 (14)

- November 2016 (14)

- November 2010 (13)

- December 2010 (13)

- June 2011 (13)

- October 2011 (12)

- December 2012 (12)

- February 2013 (12)

- January 2015 (12)

- January 2017 (12)

- May 2013 (11)

- August 2011 (10)

- March 2012 (10)

- June 2013 (10)

- December 2016 (10)

- October 2014 (9)

- April 2011 (8)

- May 2012 (8)

- September 2013 (8)

- July 2012 (7)

- December 2013 (7)

- May 2016 (7)

- February 2011 (5)

- July 2011 (5)

- April 2015 (5)

- March 2016 (5)

- November 2017 (5)

- May 2019 (5)

- July 2010 (4)

- March 2011 (4)

- August 2013 (4)

- February 2015 (4)

- August 2010 (3)

- September 2010 (3)

- August 2012 (3)

- November 2013 (3)

- February 2014 (3)

- May 2015 (3)

- October 2010 (2)

- January 2014 (2)

- July 2014 (2)

- March 2015 (2)

- December 2017 (2)

- April 2012 (1)

- May 2014 (1)

- November 2015 (1)

- March 2017 (1)

- July 2017 (1)

- February 2018 (1)

- October 2021 (1)